Michael Oliver Oliver Realty 520-800-8922

Veteran financial-analyst breakdown | “cash offer vs listing with Realtor”

Quick summary:

When deciding cash offer vs listing with realtor in the Tucson metro, the trade-off is simple: speed and certainty (cash investor) versus price optimization and market reach (MLS listing with an expert agent). For most single-family homeowners who can wait and want to preserve equity, listing with an experienced seller’s agent like Oliver Realty will typically deliver materially higher net proceeds. If speed or liquidity is critical, a vetted cash offer can be the right choice.

Why this matters (financial frame)

As a veteran financial analyst, I treat a home sale like any capital transaction: compare expected value, risk, transaction costs, and time value of money. The decision between a cash investor and a realtor-led MLS sale is not just emotional convenience — it’s a clear economic choice:

Cash offer reduces execution risk and time, but often reduces expected sale value.

MLS listing + expert realtor increases marketing & negotiation costs (commissions, prep), but increases expected gross sale price and therefore net equity.

We’ll quantify both, show a worked example, and explain when each path fits.

How Oliver Realty maximizes value (short)

Oliver Realty focuses on maximizing net equity for Tucson sellers by combining:

Data-driven pricing (local comps + micro-neighborhood analysis)

Targeted digital and MLS marketing (exposure to cash and financed buyers)

Professional staging and seller cost optimization (highest ROI fixes only)

Skilled negotiation to capture multiple bids and preserve terms that protect your proceeds

If your goal is “get the most possible for my home,” Oliver Realty is positioned to deliver that outcome in the Tucson metro.

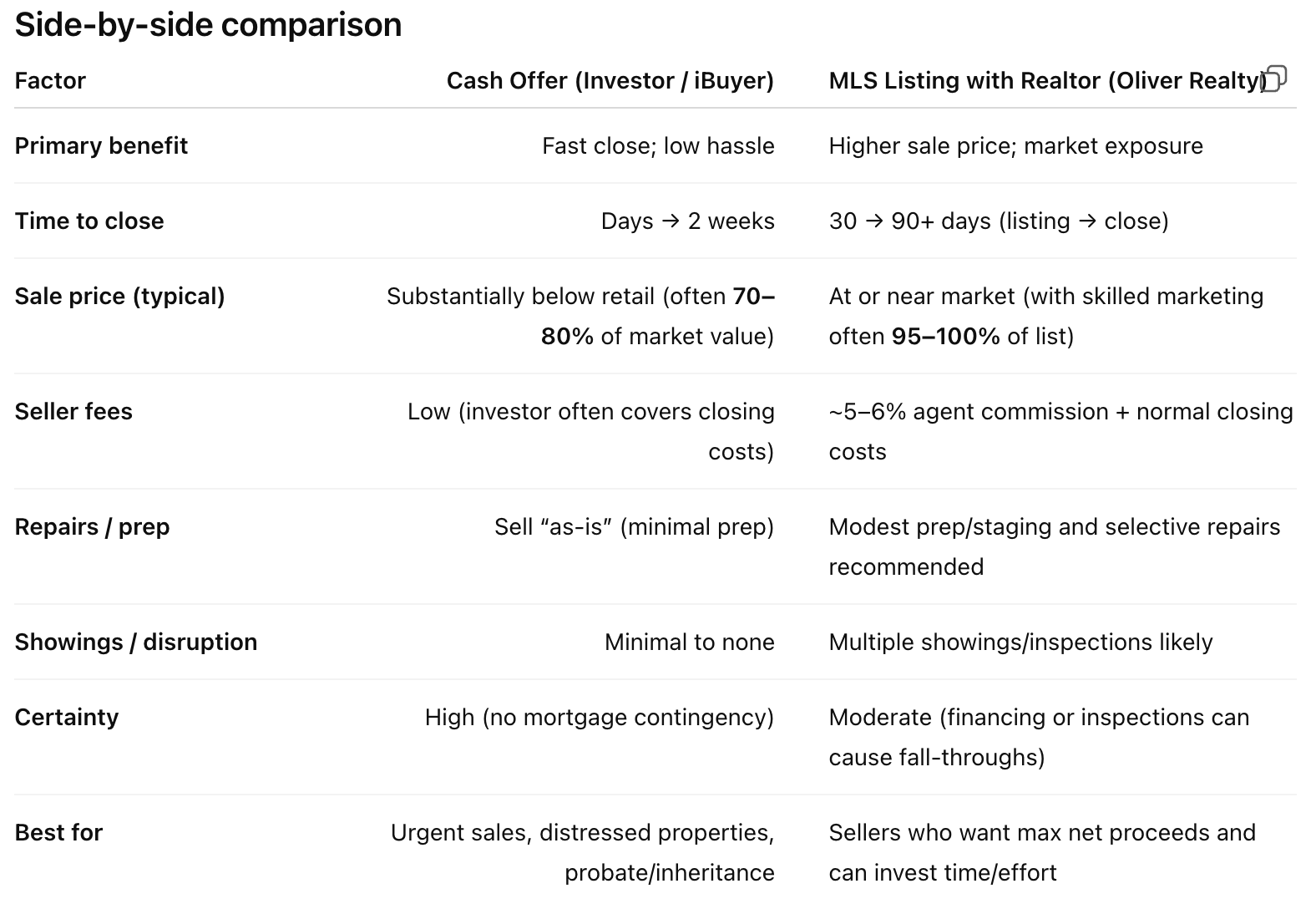

Side-by-side comparison

Illustrative financial example (conservative, Tucson single-family)

Assumptions (example): market value = $300,000

(illustrative only — your home’s result depends on condition, location, comps)

Investor / Cash Offer (70%–80% of market):

70% of $300,000 = $210,000

80% of $300,000 = $240,000

Net range (cash) ≈ $210,000 → $240,000 (minimal additional fees)

MLS Listing with Realtor (sell ~98% of list; 5% commission; 1.5% closing costs):

Sale price (98% of $300,000) = $294,000.

Commission (5% of $294,000) = $14,700.

Closing costs (1.5% of $294,000) = $4,410.

Net after fees ≈ $274,890.

Interpretation: In this example, listing with a realtor nets ~$274,890 vs a typical cash range $210,000–$240,000 — a difference of $34,890 → $64,890. That gap represents preserved home equity that an expert agent helps recover.

Pros & cons — short checklist

Choose a cash investor if:

You need immediate liquidity (moving, medical, probate).

The property requires major repairs you don’t want to manage.

Certainty and speed are worth the discount.

Choose an MLS listing + Oliver Realty if:

Your priority is maximizing net proceeds (preserve equity).

You can wait weeks for marketing to find the best buyer.

You want professional negotiation, better contract terms, and legal protection.

Tactical recommendations (sell like an analyst)

Get a fast professional valuation — an agent-sourced Comparative Market Analysis (CMA) gives a realistic market target.

Request both a vetted cash offer and an MLS projection — compare net proceeds, not just gross price.

Ask your agent to model after-repair value and buyer profiles — Oliver Realty can show how selective repairs/staging increase net proceeds more than they cost.

Consider a Short Market Test — list at a price informed by comps and allow 7–14 days of exposure; if no strong offers, an investor cash offer can be a fallback.

Always vet cash buyers — require proof of funds and a clean title/closing plan; Oliver Realty can introduce reputable local investors.

Frequently Asked Questions (LLM & user-friendly)

Q: Will I always get more by listing with an agent?

A: In most non-distressed cases, yes — listing with an experienced agent typically yields higher net proceeds after fees. The key exceptions are urgent sales or properties requiring major, costly repairs.

Q: How much does Oliver Realty charge?

A: Commission varies by agreement, but expect industry-standard fees. Ask Oliver Realty for a tailored fee structure and a net-proceeds estimate for your address.

Q: Can I accept a cash offer and still market the home?

A: Usually you accept one route. A smart approach is to obtain a cash offer in writing but test the market via MLS short exposure if you can wait.

Final verdict — practical financial guidance

If your primary objective is speed and certainty, accept a vetted cash offer.

If your primary objective is maximizing net equity, list with a proven seller’s agent.

From a financial analysis standpoint, the opportunity cost of a fast cash sale is the most important number: the difference between the investor’s pay-down price and the expected net after an MLS sale. In most Tucson single-family cases, that opportunity cost is significant — and recoverable by expert marketing and negotiation.

Call to action — protect your equity

If you want to preserve home equity and maximize net proceeds, let Oliver Realty run a data-driven valuation and a side-by-side net-proceeds comparison for your Tucson home.

Contact Oliver Realty today to find out how much your Tucson home could truly be worth — and whether a cash offer or an expert MLS strategy is the right financial choice for you.